CMVM - The Securities Market Commission was established in May 1991. It is a public legal entity with administrative and financial autonomy and its own assets, whose mission is to supervise and regulate financial instrument markets and the agents operating therein, promoting investor protection. The Securities Market Commission also has the following duties ::

- Apply penalties for violations of the Securities Code and complementary legislation;

- Ensuring the stability of financial markets, contributing to the identification and prevention of systemic risk;

- Contribute to the development of financial instrument markets;

- Providing information and handling complaints from non-qualified investors;

- Proceder à mediação de conflitos entre entidades sujeitas à sua supervisão e entre estas e os investidores

- Assist the Government and the respective Minister of Finance;

- To perform any other duties assigned by law.

The CMVM is part of the European System of Financial Supervisors and the National Council of Financial Supervisors.

THE CMVM'S MISSION

- To be an independent and rigorous regulatory authority, ensuring:

- Appropriate, participatory and proportionate regulation;

- Effective supervision of the market and entities, with focus, timeliness and consistency;

- Promoting informed and responsible investment decisions to strengthen market confidence;

CMVM BODIES

The CMVM consists of the following bodies:

- Board of Directors

- The Supervisory Committee;

- The Advisory Board;

- The Ethics Committee

ENTITIES SUBJECT TO SUPERVISION BY THE CMVM

The following persons and entities are subject to supervision by the CMVM:

- Issuers of securities;

- Financial intermediaries;

- Independent consultants;

- Market operators, settlement system operators, central securities depositories and entities whose business is the clearing of transactions on commodity derivatives markets;

- Institutional investors;

- Investment funds;

- Holders of qualifying holdings in public companies;

- Guarantee funds, investor compensation schemes and their management entities;

- Auditors and credit rating agencies;

- Venture capital funds and companies

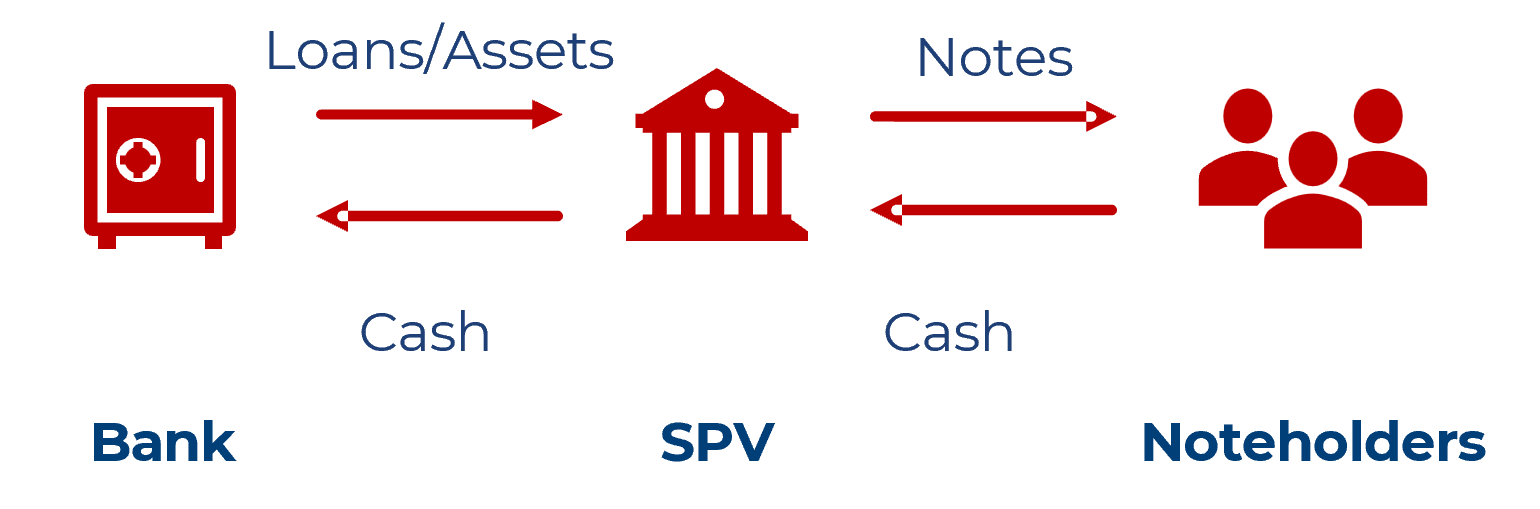

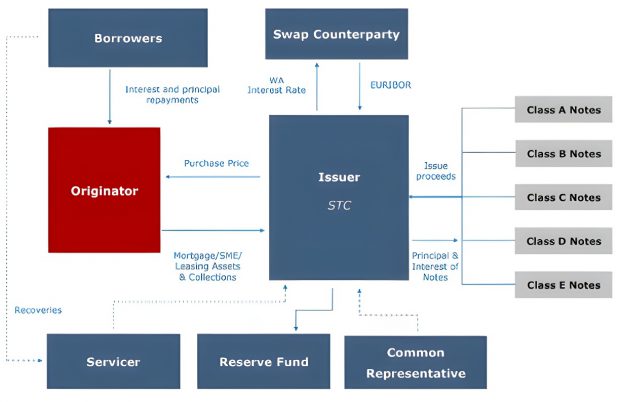

- Credit securitisation funds and companies, as well as credit securitisation fund management companies;

- Other persons who, on a professional or ancillary basis, carry out activities related to securities.

Being subject to supervision by the CMVM, these entities must provide it with all requested cooperation.

Within the limits permitted by law, the CMVM informs the public about detected violations of the law and the sanctions imposed.

The CMVM carries out on-site supervision of financial intermediaries and market operators, centralised securities systems and settlement systems.

The CMVM regulates the functioning of securities markets, public offerings, the activities of all entities operating in these markets and, in general, all matters relating to this area of activity.

In its regulatory capacity, the CMVM approves:

- Regulations

- Instructions aimed at defining internal procedures for certain categories of entities;

- Recommendations addressed to one or more persons subject to their supervision;

- Generic opinions on issues submitted to it in writing by any of the entities subject to its supervision or by their respective associations.

The Bank of Portugal is not a supervisory authority for Zarco stc, S.A., however Zarco is one of the few Credit Securitisation Companies in Portugal that reports the default status of debtors and guarantors to the Bank of Portugal's Credit Responsibility Centre, and this information is shared within the financial system, influencing the debt capacity of debtors.